How the IRC’s Center for Economic Opportunity Is Making Finance More Inclusive

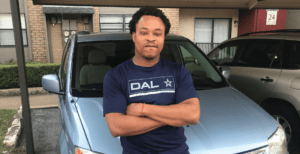

Charles, a client of IRC’s Center for Economic Opportunity. Photo courtesy of IRC-CEO.

Access to banking and financial services enables economic mobility. However, many refugees and immigrants in the United States face barriers to affordable financing, especially when they are new to the country and haven’t yet established their credit history. Improving financial access and inclusion is key to ensuring that more refugees and immigrants can invest in their own futures.

The International Rescue Committee’s Center for Economic Opportunity (CEO) is addressing this issue by making affordable loans to borrowers who have little access to traditional financing, particularly refugees and immigrants. CEO’s loans fill gaps in financial inclusion while also providing new Americans with financial coaching and other opportunities to develop money management skills. In December, the WES Mariam Assefa Fund announced its first impact investments, among them an investment in IRC’s CEO to support the organization’s efforts to reach more refugees and immigrants who could benefit from having greater access to financial services and education.

A new report by the IRC and CEO looks at credit outcomes of CEO’s clients and shows meaningful gains in the clients’ credit ratings. According to the study, which examined scores of 1,234 clients, 83 percent either improved (56 percent) or maintained (27 percent) their starting credit tier. The clients surveyed came from 66 discrete countries of origin, and most had entered the U.S. as refugees or asylum seekers sometime in the last 10 years. These clients had been in the U.S. for an average of 3.2 years at the time of their first CEO loan.

One CEO client, Charles, and his family arrived in the U.S. as refugees from Nigeria in late 2019 and began working with the IRC in Dallas. After only one year in the U.S., Charles and his family have made admirable progress toward their financial goals, including purchasing a home one day.

After paying back a credit-building loan from CEO, Charles went from not having a credit score at all to having a “good” score. He and his wife both began jobs and have resumed their college education in the evenings. With a positive credit score and stable income, Charles and his wife are now planning to finance a home. The family also purchased a car with an auto loan from CEO, so they have reliable transportation to and from their jobs and classes.

Illustrating the power of this integrated model, CEO’s new report shows a positive correlation between the loan and coaching Charles and his wife received and their improved credit scores. CEO’s combination of low-interest, client-focused products and financial coaching can equip refugees like Charles with critical tools to establish their lives in the U.S. and achieve their goals.

Read the full Credit Outcomes Study from the IRC and CEO here, and stay tuned for more on the WES Mariam Assefa Fund’s first impact investees.