Catalytic Investments

Through our catalytic investment portfolio, we invest patient, flexible, and risk-tolerant capital across the spectrum of financial returns. Our investments support markets and communities that have been historically overlooked and underinvested in, demonstrating new models and unlocking additional capital to achieve impact at scale.

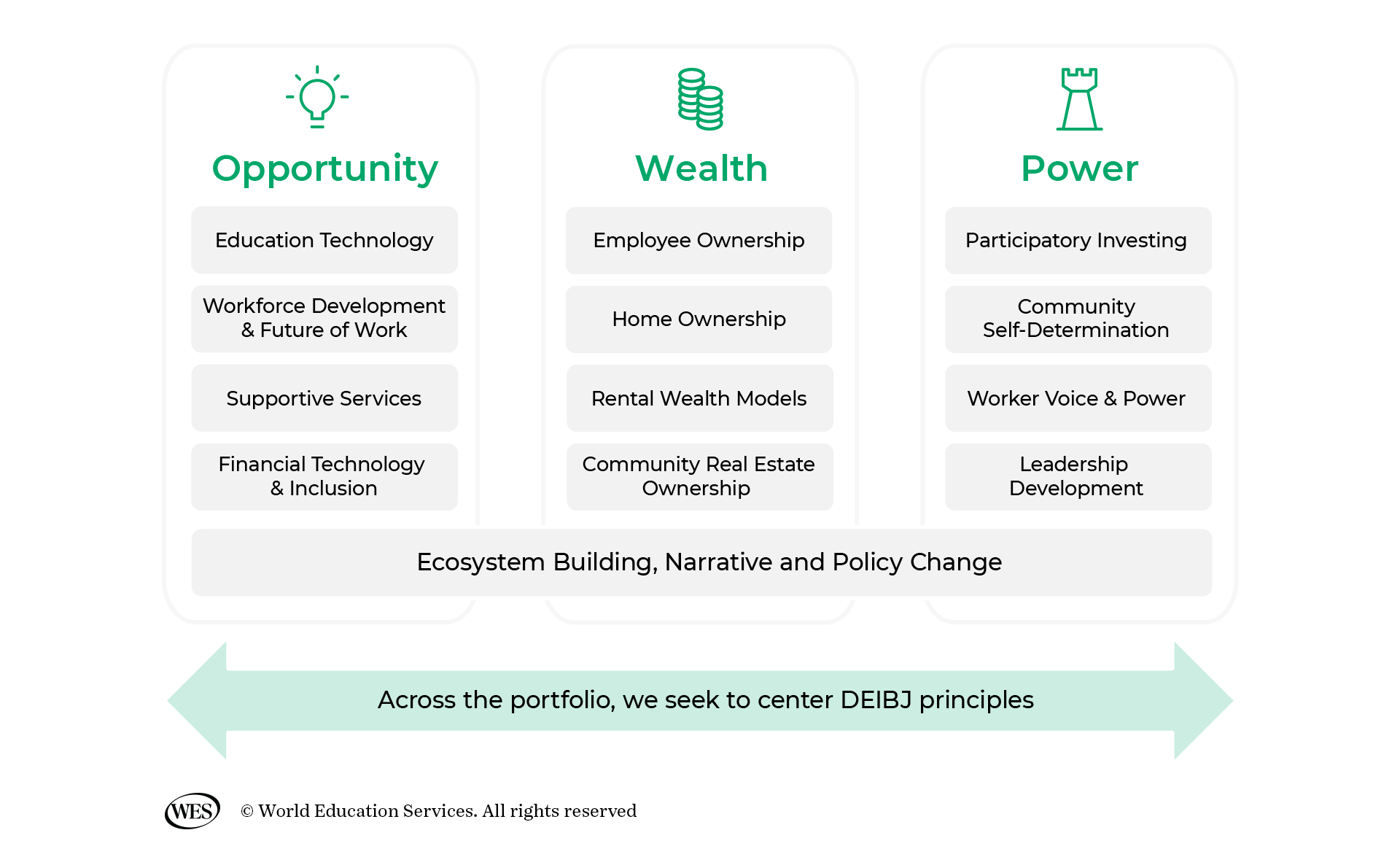

We engage an impact-first investment approach, screening opportunities based on alignment with WES’ mission, values, and three impact themes: opportunity, wealth, and power.

Across the portfolio, we also support ecosystem-building initiatives, such as narrative and policy change efforts to ensure more inclusive and equitable economies. Finally, we seek to center Diversity, Equity, Inclusion, Belonging, and Justice (DEIBJ) principles across where, what, and how we invest.

We often act as a source of early institutional capital, engaging in “family and friends” rounds and offering important signals to the market. As trust-based investors, we tailor our approach so prospective investee partners can access the right capital and terms to achieve their goals. We seek to ensure that mission-driven organizations have the flexible capital they need to demonstrate the viability of a new initiative, avail themselves of unexpected opportunities, invest in their people and operations, and flourish even amid uncertain conditions.

Investment Parameters

| Organization Type | Non-profit and for-profit entities |

| Geographic Focus | U.S. and Canada, with select strategic global investments |

| Target Populations | Underserved and overlooked communities, namely migrants, displaced people, and international students. Incorporate intersectional identities, such as race, gender, sexual orientation, citizenship status, etc. |

| Investment Types | – Direct equity and debt – Fund investments – Innovative finance (e.g., blended finance, revenue-based finance, income share agreements, etc.) – Guarantees – Recoverable grants and ecosystem-building grants |

| Stage | Early-stage organizations and concepts (e.g., Pre-seed to Series A ventures or emerging, first-time fund managers) |

| Expected Return | Capital preservation, tracking long-term inflation |

| Investment Size | Typically USD $100,000 to $500,000, up to $1M |

We are pioneering a trust-based investing process, embedding DEIBJ principles in all aspects of our work. We define “trust-based investing” as an investment philosophy and approach that reimagines the relationships between investors, investee partners, and communities to rebalance power.

In practice, this means meeting innovators where they are and moving quickly. On average, our due diligence process ranges from 30 to 90 days. To address power imbalance and information asymmetry, we seek to be transparent about our process.

We use the following criteria to assess potential investments:

Diligence Criteria

| Social Impact | – What is the potential to contribute to WES’ mission, values, and three impact themes: opportunity, wealth, and power? – How does this model address the root causes and structural barriers that immigrants and communities of color face? – Will we provide strategic and catalytic value to the prospective partner? |

| Business Model | – What is the organization’s path to sustainability, profitability, and scale? – How is the model innovative and unique? To what extent does it center the voices of proximate communities? – What is the market and competitive landscape? |

| Organizational Health | – What does the diversity and lived experience of leadership look like? – How strong are the organization’s systems and infrastructure? – How does the team integrate DEIBJ into its work and culture? |